Insurance is a term that we hear often, but many people still don’t fully understand what it means or how it works. Whether it’s for your health, car, home, or business, insurance is a fundamental part of managing risk and protecting your financial future. For those who are just getting started with the concept of insurance, it can be overwhelming. But don’t worry, this beginner’s guide will walk you through everything you need to know about insurance—how it works, the different types available, and why it’s so important for your financial security.

Key Takeaways

- Insurance is a financial product that helps mitigate risks by covering potential costs associated with accidents, health issues, and other unforeseen events.

- There are various types of insurance, including health, life, auto, and business insurance, each offering unique benefits.

- Insurance works by having you pay regular premiums in exchange for coverage in case of an emergency or loss.

- The main goal of insurance is to provide financial protection, offer peace of mind, and safeguard your loved ones from financial hardship.

- Understanding terms like premiums, deductibles, and claims is crucial for making the best insurance decisions.

What is Insurance?

At its core, insurance is a financial arrangement that helps you manage the risk of unforeseen events, such as accidents, illnesses, or property damage. When you purchase insurance, you are essentially transferring the financial risk of these events to an insurance company. In exchange for this coverage, you pay the insurance company a regular fee known as a premium.

In the event of a covered loss, the insurance company compensates you for the expenses or damages according to the terms outlined in your policy. This can help alleviate the financial burden of unexpected events and protect your assets.

How Insurance Works: The Basics

The basic premise of insurance is quite simple: you pay a premium in exchange for financial protection. Here’s a step-by-step breakdown of how insurance works:

- You Buy Insurance

To begin with, you purchase an insurance policy. This policy outlines the type of insurance coverage you have, the amount of protection it offers, the exclusions (things not covered), and the amount you must pay in the event of a claim. - You Pay Regular Premiums

Once you’ve chosen the right insurance policy, you agree to pay premiums to the insurance company. Premiums are typically paid monthly, quarterly, or annually. The amount you pay can depend on several factors, such as the level of coverage, the type of insurance, and your risk factors (e.g., age, health, driving record, etc.). - The Insurance Company Takes On the Risk

When you purchase insurance, the insurance company assumes the financial risk associated with the events covered in your policy. In other words, if an unfortunate event happens that falls under your coverage (such as a car accident, medical emergency, or property damage), the insurance company is responsible for helping cover the costs. - Making a Claim

If a covered event occurs, you can file a claim with your insurance company. This is a request for the insurer to pay for some or all of the expenses related to the event. Depending on the type of insurance and the circumstances, the insurer may cover the full amount of the damages or costs, or they may pay a partial amount. - Insurance Adjuster and Payout

Once a claim is filed, the insurance company may send an adjuster to assess the damage or verify the event. The adjuster will review the details of your claim, such as medical records or repair estimates, and determine how much the insurer should pay. After this process, the insurance company will issue a payout, either directly to you or to the service provider (e.g., a hospital, mechanic, or repair company). - Deductibles and Co-pays

Many insurance policies come with a deductible, which is the amount you must pay out of pocket before your insurance coverage kicks in. For example, if your car is damaged in an accident, and your deductible is $500, you would need to pay that amount first. The insurance company will then cover the remaining costs, up to the policy limit. Some policies also include co-pays, which are fixed amounts you pay for services (e.g., doctor visits) before insurance covers the rest.

Types of Insurance

There are several types of insurance that you might encounter, depending on your personal needs and circumstances. The most common types of insurance include:

- Health Insurance

Health insurance helps cover the cost of medical expenses, such as doctor visits, hospital stays, and surgeries. It may also cover prescription medications, preventive care, and mental health services. - Life Insurance

Life insurance provides a financial benefit to your beneficiaries (e.g., family members) in the event of your death. It can help cover funeral expenses, pay off debts, and provide ongoing financial support to those who depend on you. - Auto Insurance

Auto insurance covers damage to your vehicle or others’ vehicles in the event of an accident. It also covers liability in case you’re responsible for an accident that causes injury or damage to other people or property. - Homeowners or Renters Insurance

Homeowners insurance protects your home and belongings in the event of fire, theft, or natural disasters. Renters insurance, on the other hand, covers your personal property within a rented home or apartment, as well as liability for injuries that occur on the property. - Disability Insurance

Disability insurance provides income replacement if you become unable to work due to illness or injury. This helps ensure you still have a source of income if you are unable to perform your regular job duties. - Business Insurance

Business insurance covers various risks that businesses face, including property damage, liability claims, and employee-related risks. Types of business insurance include general liability, workers’ compensation, and professional liability insurance. - Travel Insurance

Travel insurance covers unexpected events that may occur while traveling, such as trip cancellations, medical emergencies, or lost luggage.

Why is Insurance Important?

| Reason | Explanation |

|---|---|

| Risk Mitigation | Spreads financial risk by covering unexpected events. |

| Financial Protection | Helps cover costs for accidents, illness, or property damage, preventing large financial loss. |

| Peace of Mind | Provides reassurance knowing you’re financially protected in case of emergencies. |

| Legal Compliance | Many types of insurance (e.g., auto, health) are legally required. |

| Protection for Loved Ones | Life insurance ensures your family is financially supported after your death. |

Insurance plays a vital role in protecting you and your loved ones from financial hardship. Here are some of the reasons why having insurance is important:

- Risk Mitigation

Insurance helps spread the risk of financial loss. Instead of bearing the full cost of an accident or loss, insurance allows you to share that risk with the insurer, making it more manageable. - Financial Protection

Insurance offers financial protection in the event of an emergency or unexpected event. Without insurance, you may be forced to pay for costly repairs or medical treatments out of pocket, which could potentially drain your savings. - Peace of Mind

Knowing that you’re covered by insurance gives you peace of mind. You can go about your daily life knowing that you have a safety net in place in case something goes wrong. - Compliance with the Law

In many places, certain types of insurance are mandatory. For example, most states in the U.S. require drivers to have auto insurance, and some countries require health insurance. Having the necessary insurance ensures that you comply with legal requirements. - Protection for Loved Ones

Life insurance, in particular, ensures that your family members are financially protected after your death. It can provide them with the funds they need to cover expenses and maintain their lifestyle.

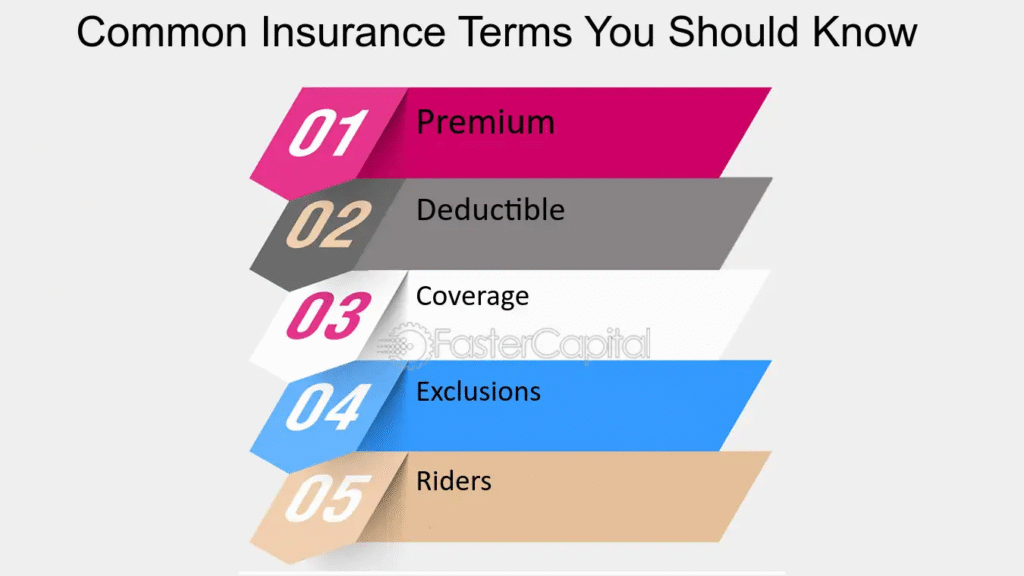

Common Insurance Terms You Should Know

Before diving into insurance, it’s essential to understand some common terms associated with insurance policies:

- Premium: The amount of money you pay to an insurance company for coverage.

- Deductible: The amount you must pay out of pocket before your insurance coverage kicks in.

- Claim: A request for payment from your insurer for covered losses.

- Coverage: The protection provided by your insurance policy.

- Policy Limit: The maximum amount an insurance company will pay for a covered claim.

- Exclusions: Specific circumstances or events that are not covered by your insurance policy.

- Underwriting: The process by which an insurance company assesses the risk of insuring you and determines your premium.

Also Read : Insurance Made Simple: A Beginner’s Guide To Coverage Types

Conclusion

Insurance is an essential tool for protecting yourself, your family, and your assets from unexpected events. Whether it’s health, life, auto, or home insurance, having the right coverage can help you manage risk, reduce financial stress, and ensure that you’re not left in a vulnerable position during a crisis. Understanding how insurance works is the first step toward making informed decisions and securing your financial future.

FAQs

- Do I need insurance if I’m young and healthy?

Yes! Even if you’re young and healthy, insurance can still be beneficial. Health insurance can cover unexpected medical costs, and life insurance can provide security for your family if something happens to you unexpectedly. - How can I lower my insurance premiums?

To lower your premiums, you can consider increasing your deductible, maintaining a good credit score, bundling multiple policies (e.g., home and auto insurance), or shopping around for the best rates. - What happens if I miss a premium payment?

Missing a premium payment can result in a lapse in coverage, meaning your insurance policy may be canceled. Most insurers offer a grace period, but it’s essential to make payments on time to avoid losing coverage. - Is insurance the same as an investment?

No, insurance is not an investment. It provides financial protection against risks, but it doesn’t offer the same return on investment as stocks or bonds. - What does “underwriting” mean in insurance?

Underwriting is the process by which an insurer evaluates your risk and determines whether to accept you as a policyholder, as well as how much your premiums should be. - Can I cancel my insurance policy anytime?

Yes, most insurance policies can be canceled at any time. However, be aware of potential penalties or fees for early cancellation, and always review the terms of your policy before making a decision. - What should I do if I need to file a claim?

To file a claim, contact your insurance company as soon as possible. Provide all necessary information, such as the details of the event, any documentation or evidence (e.g., photos, police reports), and any bills or receipts related to the incident.