Insurance Made In today’s uncertain world, insurance is more than just a safety net—it’s a necessity. Whether it’s for your health, your car, your home, or your life, insurance protects you from unexpected financial burdens and offers peace of mind. Yet, for many people, the world of insurance can feel confusing, filled with technical jargon and countless options. This guide breaks down the basics and helps you understand the most common types of insurance coverage so you can make informed decisions with confidence.

Key Takeaways

- Insurance spreads financial risk and protects you from high unexpected costs.

- Types of insurance vary widely, with health, life, auto, and home being the most common.

- Read your policy carefully, understanding premiums, deductibles, exclusions, and limits.

- Compare quotes and choose insurers with good reputations and responsive service.

- Customize coverage to fit your lifestyle, assets, and future goals.

What is Insurance?

Insurance Made is a contract (policy) in which an individual or entity receives financial protection or reimbursement against losses from an insurance company. The company pools clients’ risks to make payments more affordable for the insured. In essence, insurance spreads risk across a large group to reduce the burden on any one person.

How Does Insurance Work?

Insurance Made When you purchase insurance, you pay a regular fee known as a premium. In exchange, the insurer agrees to cover certain costs if a specific event occurs, like a car accident, a medical emergency, or a house fire. The scope of this coverage is detailed in your insurance policy.

If you suffer a loss covered by your policy, you file a claim, and the insurer evaluates the damage and pays out, either to you or directly to the service provider, depending on the situation.

Why Insurance is Important

- Financial Protection: Covers unexpected expenses, reducing out-of-pocket costs.

- Peace of Mind: Knowing you’re protected allows you to focus on recovery and stability.

- Legal Requirement: Some insurance types, like auto and health insurance, are legally mandated in many countries.

- Risk Management: Helps individuals and businesses manage risk more effectively.

- Wealth Preservation: Prevents major financial setbacks from derailing your financial future.

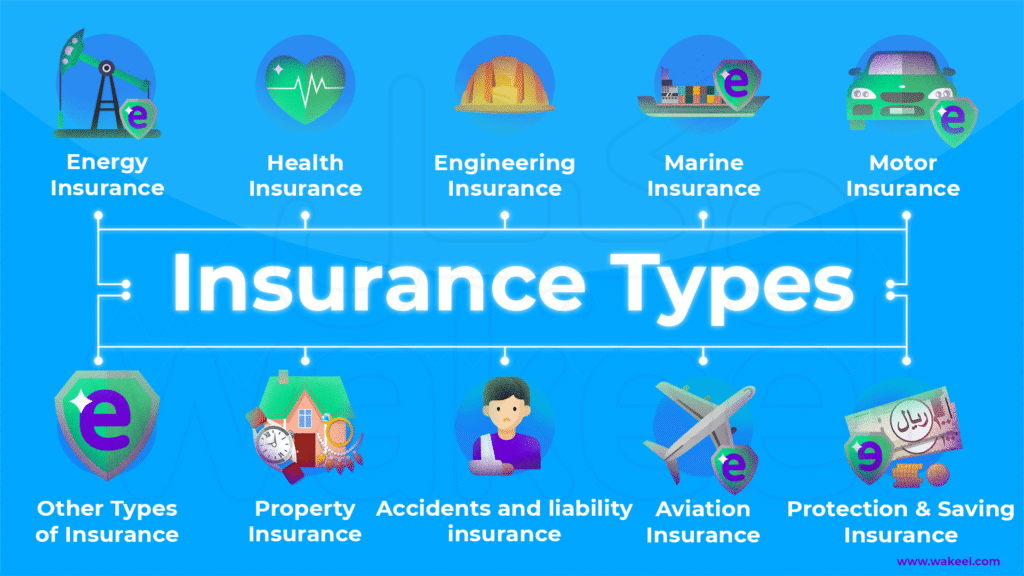

Common Types of Insurance Coverage

Health Insurance

What It Covers: Doctor visits, hospital stays, surgeries, prescription drugs, and sometimes dental and vision care.

Why You Need It: Medical care is expensive. Health insurance protects you from paying the full cost of medical services and often offers preventative care to maintain your health.

Types:

- HMO (Health Maintenance Organization)

- PPO (Preferred Provider Organization)

- High-Deductible Health Plans (HDHP)

- Medicare and Medicaid (for eligible individuals)

Life Insurance

What It Covers: Pays a sum of money to your beneficiaries upon your death.

Why You Need It: Life insurance ensures your dependents are financially supported after you’re gone.

Types:

- Term Life Insurance: Covers a specific period (10, 20, 30 years).

- Whole Life Insurance: Permanent coverage with a cash value component.

- Universal Life Insurance: Offers flexibility with premiums and death benefits.

Auto Insurance

What It Covers: Damages to your car, other vehicles, property, and injuries resulting from an accident.

Why You Need It: Often legally required and protects you from high repair bills, liability, and medical costs.

Types:

- Liability Coverage

- Collision Coverage

- Comprehensive Coverage

- Uninsured/Underinsured Motorist Coverage

- Personal Injury Protection (PIP)

Homeowners and Renters Insurance

Homeowners Insurance

What It Covers: Damage to your home and possessions due to fire, storms, theft, or vandalism. It also includes liability coverage.

Renters Insurance

What It Covers: Personal belongings, liability, and additional living expenses if your rental becomes uninhabitable.

Why You Need It: Protects your most valuable asset or your possessions in a rented space.

Disability Insurance

What It Covers: Replaces a portion of your income if you are unable to work due to illness or injury.

Why You Need It: If you’re reliant on your paycheck, disability insurance ensures income continuity.

Types:

- Short-Term Disability Insurance

- Long-Term Disability Insurance

Travel Insurance

What It Covers: Trip cancellations, medical emergencies, lost luggage, and other travel-related disruptions.

Why You Need It: Especially important for international travel where your domestic insurance may not apply.

Business Insurance

What It Covers: Property damage, liability, employee-related risks, and business interruption.

Why You Need It: Protects your company from lawsuits, disasters, and other unexpected events.

Types:

- General Liability

- Professional Liability

- Commercial Property

- Workers’ Compensation

Optional and Niche Coverages

There are also specialty insurances that cater to specific needs:

- Pet Insurance

- Flood Insurance

- Earthquake Insurance

- Wedding Insurance

- Cyber Liability Insurance

- Event Insurance

These may be crucial depending on your lifestyle, location, or assets.

Choosing the Right Insurance

When selecting insurance, consider:

- Your Needs: What are you trying to protect?

- Your Budget: Can you afford the premiums and deductibles?

- Policy Coverage: What is included and what is excluded?

- Customer Service: Is the insurer known for handling claims efficiently?

- Reputation: Look at reviews, ratings, and financial stability.

Always compare multiple quotes and read the fine print.

Understanding Policy Terms

Some common insurance terms:

- Premium: The amount you pay for coverage.

- Deductible: The amount you pay before the insurer starts covering expenses.

- Co-pay: A fixed amount you pay for services (common in health insurance).

- Coverage Limit: The maximum amount the insurer will pay.

- Exclusions: Items or events not covered by your policy.

How to File a Claim

- Document the Loss: Take photos and gather relevant documents.

- Contact the Insurer: Use their online portal, app, or phone line.

- Submit a Claim Form: Fill in all required details honestly and accurately.

- Assessment: An adjuster may be sent to assess the damage.

- Payout: Once approved, you’ll receive the reimbursement or service.

Also Read : What Does Renters Insurance Cover? Everything You Need To Know

Conclusion

Insurance doesn’t have to be intimidating. At its core, it’s a tool to help you manage risk and protect the life you’ve worked hard to build. From your health and home to your income and business, having the right insurance coverage gives you financial stability when you need it most. The key lies in understanding your unique needs, choosing the right type of coverage, and staying informed about your policies.

No matter where you are in life, insurance is an investment in your peace of mind.

FAQs

1. Is insurance mandatory?

Yes, certain types like auto and health insurance are mandatory in many jurisdictions. Others, like life or renters insurance, are optional but highly recommended.

2. What happens if I miss a premium payment?

Missing a payment can result in a grace period, after which your policy may lapse, leaving you without coverage.

3. Can I change my insurance policy later?

Yes, most policies can be modified or upgraded during renewal periods or special life events.

4. What is a deductible?

It’s the amount you pay out of pocket before your insurance kicks in.

5. Does insurance cover everything?

No. Every policy has exclusions. Always read your policy to know what’s not covered.

6. How are premiums calculated?

Based on risk factors like age, health, location, credit score, and coverage type.

7. What if someone sues me?

Liability coverage within your auto, home, or business insurance can protect you against legal claims.