Student Loan

Student loans are often seen as a necessary part of financing higher education, but as the amount of student debt continues to rise in many countries, the question remains: What’s the real cost of student loans? While the financial burden is most obvious, there are far-reaching consequences that extend beyond just monetary terms. From mental health to career choices, understanding the true cost of student loans is critical for both borrowers and policymakers. In this article, we’ll explore not only the financial implications but also the personal, social, and psychological impact of student loan debt.

Key Takeaways

- Student loan debt is not just a financial burden but also has significant mental, social, and career consequences.

- The cost of student loans can extend well beyond graduation, delaying major life milestones and affecting long-term financial stability.

- Policy changes, like income-driven repayment plans and tuition-free education, could help mitigate the crisis.

- Financial literacy and planning are essential in helping students manage their debt and avoid long-term consequences.

Understanding Student Loans: The Basics

Before we dive into the broader consequences, let’s first understand the structure of student loans and how they function. A student loan is typically a form of financial assistance designed to help cover the cost of higher education, such as tuition, books, and living expenses. Unlike grants or scholarships, student loans must be paid back with interest, and failure to repay can result in penalties.

Types of Student Loans

There are two main types of student loans:

- Federal Student Loans: These are loans funded by the government and tend to offer lower interest rates and more flexible repayment options. They include Direct Subsidized Loans, Direct Unsubsidized Loans, PLUS Loans, and Direct Consolidation Loans.

- Private Student Loans: These loans are offered by private financial institutions like banks or credit unions. Private loans tend to have higher interest rates, less flexible repayment plans, and fewer protections than federal loans.

Understanding which type of loan you have is essential to knowing your options for repayment and forgiveness.

The Financial Cost: How Much Are Students Borrowing?

| Aspect | Details |

|---|---|

| Average Amount Borrowed | $30,000 (US national average) for undergraduate students |

| Tuition Fees (Public 4-year, In-state) | $10,000 – $15,000 per year (for in-state students) |

| Tuition Fees (Private 4-year) | $35,000 – $50,000 per year |

| Average Loan Interest Rate (Federal) | 4.99% – 7.08% (varies based on loan type and year) |

| Average Loan Interest Rate (Private) | 5% – 12% (varies based on credit score and loan provider) |

| Standard Repayment Period | 10 years for federal student loans |

| Repayment Period (Income-driven plans) | 20-25 years depending on the plan (e.g., PAYE, REPAYE) |

| Total Paid Over 10 Years (for $30,000 loan at 5% interest) | $38,720 (principal + interest) |

| Total Paid Over 20 Years (for $30,000 loan at 5% interest) | $48,600 (principal + interest) |

| Loan Default Rate (US) | 11.5% (for borrowers who default within 3 years of entering repayment) |

| Federal Loan Forgiveness Eligibility | After 10 years of qualifying payments under PSLF for public service workers |

| Private Loan Repayment Flexibility | Limited compared to federal loans (no deferment or forbearance options) |

The financial cost of student loans varies depending on the country, the type of institution, and the student’s lifestyle, but the overall trend is concerning. In the United States alone, student loan debt has surpassed $1.7 trillion, affecting millions of borrowers. As tuition prices increase each year, more and more students are relying on loans to finance their education.

Rising Tuition and Borrowing

The average cost of tuition has skyrocketed in recent decades. For example, the cost of attending a four-year college in the United States has increased by over 200% since the 1980s, outpacing inflation by a significant margin. This sharp increase has led to a spike in borrowing, with the average student loan borrower owing more than $30,000 at graduation.

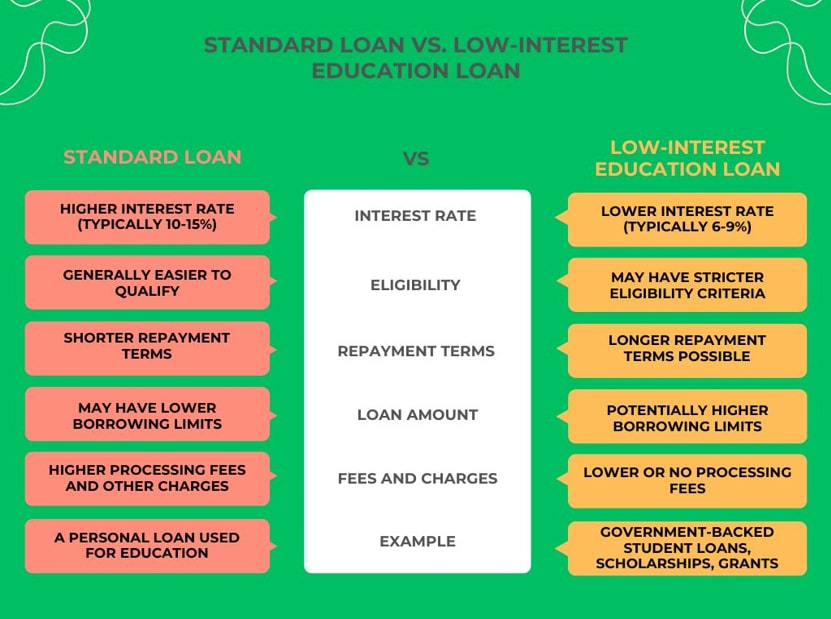

The Interest Factor

One of the major costs associated with student loans is the interest that accrues over time. Federal student loans have fixed interest rates, which are set by the government, while private loans can have variable rates that fluctuate based on the market. Regardless of the interest rate, the longer the repayment period, the more money borrowers will pay over time.

In some cases, students who take longer than 10 years to repay their loans may end up paying more than double the original amount borrowed due to compounded interest.

The Hidden Costs: Mental Health, Career Choices, and More

While the financial burden of student loans is widely discussed, the hidden costs—such as mental health issues, career decisions, and life choices—often go overlooked. These consequences can be just as devastating as the financial debt itself.

Impact on Mental Health

Student loan debt has been linked to increased stress, anxiety, and depression, particularly among young graduates. According to a study by the American Psychological Association, 62% of college students report that they are worried about their financial future, with the majority of that concern stemming from student debt. The pressure to repay loans while navigating early career choices can be overwhelming.

Many students graduate with the expectation of entering the workforce and starting their adult lives, only to find that the burden of student debt limits their career options, impedes their ability to save, and forces them to delay major life events like buying a home or starting a family.

The Effect on Career Choices

The need to repay student loans can shape career decisions in ways that limit personal and professional growth. Graduates often take jobs simply for the sake of repaying their loans, rather than pursuing careers that align with their passions or long-term goals. This is particularly true for those who hold substantial debt, which often leads them to prioritize higher-paying positions over jobs they might find more fulfilling.

Moreover, the pressure to earn more in order to pay off loans can push graduates into industries they might not otherwise consider, potentially stifling innovation and creativity in sectors like education, healthcare, and the arts.

The Delay of Life Milestones

Student loan debt often forces borrowers to delay significant life milestones. For instance, according to a report by the Federal Reserve, many borrowers delay purchasing a home or starting a family due to financial constraints. The challenge of affording rent, utilities, and student loan payments often outweighs the ability to save for a down payment or cover the costs of childcare.

This delay in life milestones can affect long-term personal happiness and stability, potentially leading to frustration and dissatisfaction with their career and personal life choices.

The Long-Term Impact: Retirement and Financial Stability

One of the lesser-discussed aspects of student loans is their impact on long-term financial security. Many borrowers find themselves struggling to save for retirement or achieve financial independence because they are focused on paying off their student loans. The longer it takes to pay off student loans, the less time a person has to save and invest for retirement.

Retirement Delays

Student loan borrowers in their 30s and 40s are particularly vulnerable when it comes to saving for retirement. They may be forced to contribute less to their retirement accounts because they are still burdened with student debt, and as a result, they may face a retirement crisis in their later years.

Financial Independence

Achieving financial independence becomes an even more daunting challenge for borrowers still paying off student loans. High student loan payments, combined with the need to manage other expenses like housing and healthcare, create a financial strain that prevents individuals from building wealth or achieving true financial freedom.

Solutions: Addressing the Real Cost of Student Loans

Given the broad and profound effects of student loans, what can be done to address this issue? Here are some potential solutions.

Income-Driven Repayment Plans

One possible solution is expanding income-driven repayment plans (IDR). These plans allow borrowers to pay based on their income, making payments more manageable and potentially reducing the total amount of debt paid over time.

Loan Forgiveness Programs

Loan forgiveness programs, such as Public Service Loan Forgiveness (PSLF), offer borrowers a way to have their loans forgiven after a set period of time if they work in qualifying public service jobs. Expanding these programs could provide much-needed relief to borrowers who are struggling with debt.

Tuition-Free College

Some have suggested making higher education more affordable by providing tuition-free college education. This solution would eliminate the need for most students to borrow money for their education in the first place, reducing the overall student debt crisis.

Financial Literacy Education

An often-overlooked solution is the importance of financial literacy education. Helping students and families understand how loans work, how interest accrues, and how to manage finances effectively can empower them to make informed decisions about borrowing.

Also Read :- Are You Getting The Best Deal On Your Car Loan?

Conclusion

The real cost of student loans is not just about the money—it extends into every aspect of a borrower’s life, including mental health, career decisions, and future financial stability. As student loan debt continues to rise, it is crucial that we consider the broader societal implications of this debt crisis. While there is no one-size-fits-all solution, policies aimed at reducing tuition costs, increasing financial literacy, and expanding loan forgiveness programs could help alleviate some of the burden on students and graduates. Ultimately, it is up to both individuals and policymakers to address the root causes and long-term consequences of student debt.

FAQs

1. What are the different types of student loans?

Student loans can be either federal or private. Federal loans include Direct Subsidized, Direct Unsubsidized, and PLUS loans, while private loans are offered by banks and other financial institutions.

2. How do interest rates on student loans work?

Interest rates on federal student loans are fixed and set by the government, while private loans can have variable interest rates that fluctuate based on the market. Interest accumulates over time, increasing the total amount owed.

3. Can student loans be forgiven?

Yes, federal student loans can be forgiven under certain programs, such as Public Service Loan Forgiveness (PSLF) or Income-Driven Repayment forgiveness. However, private loans generally do not offer forgiveness options.

4. How long does it take to pay off student loans?

The repayment period for student loans depends on the loan amount, interest rate, and repayment plan. Federal student loans typically have a standard 10-year repayment term, though income-driven repayment plans may extend the term.

5. What happens if I can’t pay my student loans?

Failure to repay student loans can result in default, which can lead to wage garnishment, tax refund seizure, and damage to your credit score. It’s crucial to contact your loan servicer to explore deferment, forbearance, or repayment alternatives.

6. Are there any programs to help pay off student loans?

Yes, programs such as Income-Driven Repayment plans and Public Service Loan Forgiveness can help borrowers manage their loans. There are also employer-sponsored loan repayment assistance programs in some industries.

7. Can student loans affect my credit score?

Yes, missed or late student loan payments can negatively affect your credit score. On-time payments, on the other hand, can help build and maintain a good credit history.