Securing a business loan can be a powerful way to fund your company’s growth or manage cash flow. However, before applying for a business loan, it’s critical to ask yourself: Can you afford a business loan right now? Whether you’re a startup or an established business, borrowing money involves responsibility and the need for a well-thought-out strategy. In this article, we will guide you through the factors to consider when assessing whether your business is in a good position to take on a loan, and provide helpful answers to common questions about business loan affordability.

Key Takeaways

- Assess your financial health before applying for a loan to ensure your business can handle repayments.

- Choose the right type of loan based on your needs and financial situation.

- Avoid overborrowing to prevent strain on your business’s cash flow and future growth.

- Ensure you have a solid repayment plan to avoid late fees or loan defaults.

Understanding the Business Loan Landscape

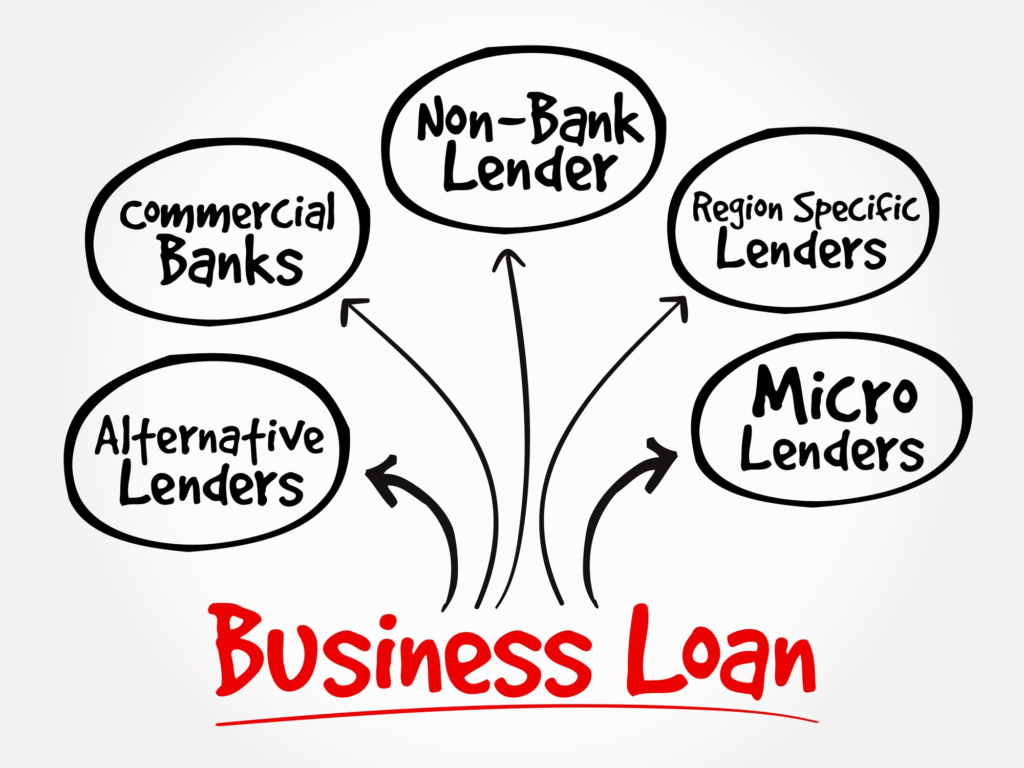

Before diving into the numbers and intricacies of loan repayments, it’s essential to understand the current business loan landscape. Loans come in various forms, from traditional term loans and lines of credit to more specialized loans such as equipment financing or SBA (Small Business Administration) loans. Each type has different terms, repayment schedules, and eligibility requirements. Moreover, the general economic environment—interest rates, lender policies, and market conditions—also plays a role in your loan’s affordability.

When evaluating if you can afford a business loan, understanding these factors will help you make an informed decision that aligns with your business goals and financial health.

Assessing Your Financial Situation

| Financial Aspect | What to Assess | Questions to Ask |

|---|---|---|

| Cash Flow | Regular income and outgoing expenses. | – Do you have consistent positive cash flow? – Can you forecast stable revenue for the next few months or years? |

| Debt-to-Income Ratio | The ratio of your existing debts to your income. | – How much debt does your business have? – What percentage of your revenue is used for debt repayment? |

| Profitability | Whether your business is profitable or not. | – Has your business been consistently profitable in the last 6 to 12 months? – Is your profit margin healthy and sustainable? |

| Assets and Collateral | Valuable business assets that can be used as collateral for a secured loan. | – Do you have assets to back up your loan? – Are you willing to risk losing these assets if repayments are missed? |

| Credit Score | Your personal and business credit scores. | – What is your personal credit score? – Does your business have a strong credit history? |

| Existing Financial Obligations | Other loans or financial obligations that may impact your ability to repay the new loan. | – How many existing financial commitments do you have? – Are there any upcoming financial obligations that may affect cash flow? |

The first step in determining whether you can afford a business loan is evaluating your business’s financial health. You need a clear picture of your current financial status, so you can understand what you can realistically handle in terms of repayment.

Cash Flow

Your business’s cash flow is perhaps the most important factor when considering a loan. Cash flow refers to the money coming in and going out of your business. Lenders typically look for a consistent cash flow to ensure that your business can handle monthly payments without falling into financial distress.

Key questions to ask:

- Do you have positive cash flow each month?

- Can you forecast stable revenue for the next few months or years?

Debt-to-Income Ratio

The debt-to-income (DTI) ratio is another critical indicator of your business’s ability to manage debt. It compares your existing debts to your income. A high DTI ratio signals that your business is already heavily reliant on borrowed money, which could make lenders cautious about approving another loan.

Key questions to ask:

- How much debt do you currently have?

- What percentage of your revenue is dedicated to paying down this debt?

A DTI ratio above 40% could indicate that taking on more debt might strain your finances.

Business Profitability

Profitability is directly tied to your ability to repay any loan you take out. If your business isn’t profitable or struggling to make a profit, borrowing money could exacerbate the problem. A lender will want to see that your business has a history of profitability or that you have a clear, realistic path to profitability in the future.

Key questions to ask:

- Have you been consistently profitable for the past 6 to 12 months?

- Is your business’s profit margin healthy?

Assets and Collateral

If your business is considering a secured loan, collateral may be required. Collateral are assets that can be seized by the lender in case you fail to repay the loan. This could include real estate, equipment, or other business assets. Having valuable assets can increase your chances of securing a loan, but it also comes with the risk of losing them if you default.

Key questions to ask:

- Do you have assets that can be used as collateral?

- Are you willing to risk losing these assets if you can’t make repayments?

Loan Types and Their Impact on Affordability

Understanding the different types of business loans can help you make a more informed decision on which one fits your needs and financial capacity. Below are the most common types of loans and their impact on affordability:

Term Loans

A traditional term loan provides you with a lump sum of money that you repay over a fixed period with interest. The repayment schedule is typically monthly, and the loan term can range from a few months to several years. These loans are great for businesses looking for large amounts of capital for specific projects or expansions.

However, term loans can be a heavy financial commitment, and repayment schedules can be stringent. If your cash flow is unstable or if you’re unsure of your future profitability, term loans may not be the best fit.

Lines of Credit

A business line of credit is a revolving form of credit that allows you to borrow up to a specific limit. Interest is only paid on the amount you use, and once you repay it, you can borrow again. This option is great for businesses that need flexible access to funds for operating expenses or short-term needs.

A line of credit offers more flexibility but can also tempt businesses to overborrow. It’s crucial to keep careful track of your borrowing to avoid exceeding your capacity to repay.

SBA Loans

SBA loans are government-backed loans designed to help small businesses. They typically offer lower interest rates and longer repayment terms compared to conventional loans. These loans are especially helpful for startups or businesses with limited financial history.

The downside to SBA loans is that they can take longer to process and come with extensive documentation requirements. If you need quick access to funds, this may not be the best option.

Equipment Financing

If you need funding to purchase equipment, machinery, or technology, equipment financing can help. In this case, the equipment itself acts as collateral for the loan. Since equipment financing is tied directly to the asset being purchased, it can be a more affordable option for businesses with predictable cash flow and a clear need for the equipment.

The Loan Application Process

Once you’ve assessed your financial situation and decided on a loan type, it’s time to start the application process. Here are the typical steps involved:

- Prepare Your Documents: Lenders will require documentation of your business’s financial health. This includes tax returns, profit-and-loss statements, balance sheets, and cash flow statements. If you’re applying for an SBA loan, you will need to provide additional documents like your business plan.

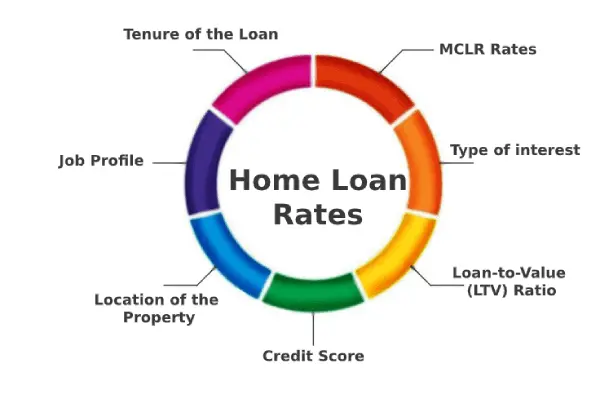

- Check Your Credit Score: Lenders will also review your personal and business credit scores to assess your creditworthiness. A higher score can improve your chances of securing favorable loan terms.

- Choose Your Lender: Research different lenders, including banks, credit unions, and online lenders, to find the best rates and terms for your business.

- Submit the Application: Once you’ve gathered the necessary information, submit your application. Depending on the lender, you may receive approval within a few days or weeks.

- Review the Offer: If you’re approved, carefully review the loan terms, including the interest rate, repayment schedule, and any additional fees. Make sure the terms align with your financial capacity.

Risks of Overborrowing

While borrowing money can help your business expand, it comes with risks. Overborrowing is a common pitfall that many businesses fall into, especially if they underestimate their repayment capacity or overestimate their future income.

Some risks of overborrowing include:

- Cash Flow Problems: Monthly loan repayments can become a significant strain on your cash flow, particularly if your business experiences a dip in revenue.

- Interest Costs: If you borrow more than you can afford to repay, the interest costs can accumulate quickly, making the loan more expensive over time.

- Default and Legal Consequences: Failing to repay a business loan can result in default, damage to your credit score, and potential legal action.

How to Ensure You Can Afford a Business Loan

Before taking on a loan, here are a few strategies to ensure you can manage it effectively:

- Create a Solid Business Plan: A well-thought-out business plan will help you understand how you’ll use the loan and how you’ll generate the necessary revenue to repay it.

- Start Small: If possible, borrow only the amount you need. Borrowing more than necessary increases your risk and monthly obligations.

- Build a Cash Cushion: Try to maintain a cash reserve to cover any unexpected expenses. This can help avoid issues if your business experiences financial setbacks.

- Regularly Review Your Financial Health: Track your cash flow and other financial metrics regularly to ensure you’re on track with repayments.

Also Read :- What’s The Real Cost Of Student Loans?

Conclusion

Before committing to a business loan, it’s essential to evaluate your financial situation, the type of loan, and your ability to handle monthly repayments. If your business has healthy cash flow, low existing debt, and solid profitability, taking on a loan may be a good move. However, if you’re uncertain about your financial capacity, it’s better to hold off and reassess your options.

By understanding your financial health, being mindful of overborrowing, and selecting the right loan for your needs, you can make an informed decision that supports your business’s growth without jeopardizing its financial stability.

FAQS

1. What is the minimum credit score required for a business loan?

The minimum credit score needed varies depending on the type of loan and lender, but generally, a score of 650 or higher is considered good. Some lenders may accept scores as low as 500, especially if the loan is secured.

2. How much of a business loan can I afford?

You should only borrow what you can comfortably repay based on your business’s cash flow. It’s advisable to calculate your debt service coverage ratio (DSCR) to ensure the loan won’t strain your finances.

3. Can I get a business loan with bad credit?

Yes, but it’s more challenging. You may need to explore alternative lenders, such as online lenders or secured loan options, which may accept lower credit scores.

4. What is the interest rate on a business loan?

Interest rates vary by lender, loan type, and your creditworthiness. On average, interest rates range from 3% to 30%, with higher rates typically applied to riskier loans.

5. Can I get a business loan without collateral?

Yes, some lenders offer unsecured loans. However, these loans may come with higher interest rates or stricter qualification criteria.

6. How long does it take to get approved for a business loan?

Approval times can vary. Traditional banks may take several weeks, while online lenders may offer quicker turnaround times, often in a few days.

7. Can I use a business loan for personal expenses?

No, business loans should only be used for business purposes, such as expansion, equipment purchase, or operating expenses.